old (XAUUSD) enters today’s US session at a critical crossroads as markets await the US Retail Sales release at 13:30 GMT. Expectations of strong consumer data, easing US-Iran tensions, and a potentially more hawkish Federal Reserve stance are shifting risk sentiment toward the US Dollar. Together, these factors could reduce safe-haven demand and apply downside pressure on gold prices in the near term.

Today’s given signal : https://t.me/calendarsignal/23538

Why Traders Might Expect Gold (XAUUSD) to Fall Today

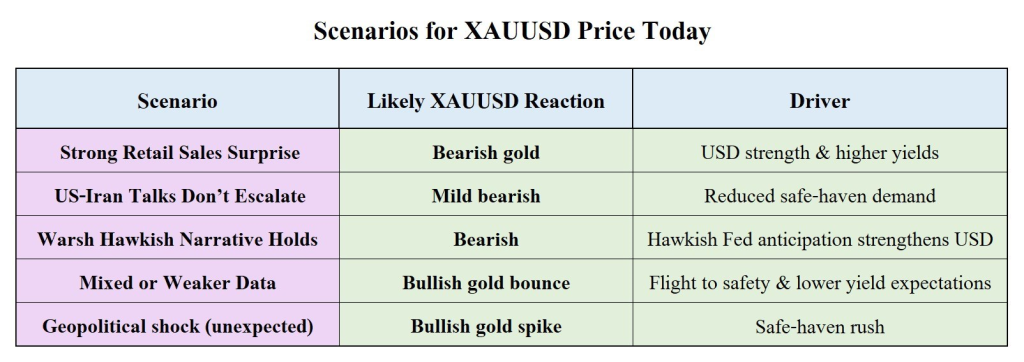

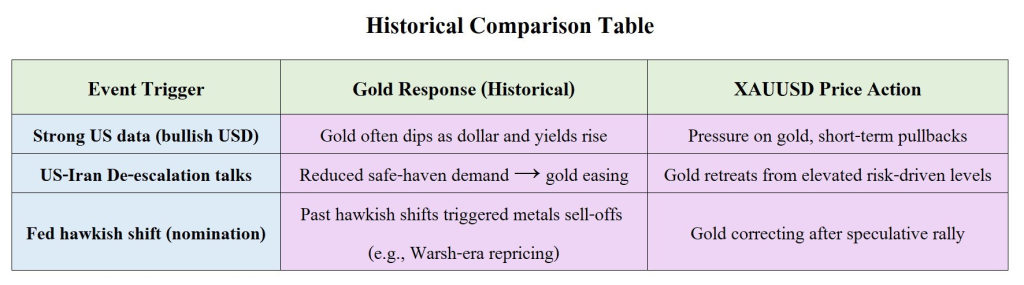

Gold (XAUUSD) often reacts to macro data and risk sentiment. On 10 February 2026, three major themes could push prices lower — at least initially — once the US Retail Sales report is released:

1) Strong US Retail Sales → Strong USD → Gold Sells Off

- Retail sales data at 13:30 GMT measures consumer spending — a key driver of US economic growth.

- If Retail Sales come in significantly above expectations (indicating robust spending), investors will price in stronger economic growth and higher future interest rates, pushing the US Dollar higher.

- A stronger dollar makes gold (priced in USD) more expensive for holders of other currencies, reducing demand and often triggering gold selling. This USD-gold inverse relationship is a staple in macro markets.

2) Positive US-Iran Talks → Reduced Safe-Haven Demand

- Ongoing diplomatic progress between the US and Iran and easing of military tensions tends to reduce fear-driven buying of gold.

- Investors often use gold as a safe-haven hedge when geopolitical risk is rising; if talks suggest de-escalation, that impulse fades.

3) Kevin Warsh FED Narrative → Hawkish USD Bias

- Market participants have viewed Kevin Warsh’s nomination as Federal Reserve chair as potentially hawkish on monetary policy, especially as someone historically concerned with inflation — although recent commentary shows nuance.

- Hawkish tone or perceptions of slower or fewer rate cuts than markets priced strengthen the US Dollar and support bond yields — both of which tend to pressure gold prices.

- If the prospective Fed path tilts toward tighter conditions, gold’s opportunity cost (no yield) rises, dampening its appeal.

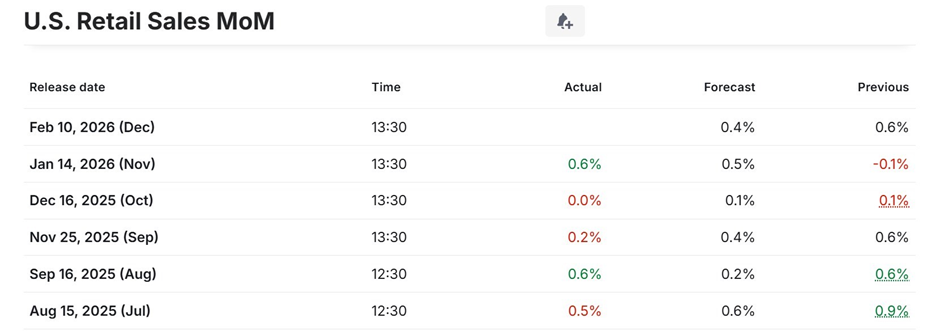

Previous released data results :

On last Retail Sales data (14-1-2026) we predicted good data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 191 points according to the signal we gave.

Check last given signal : https://t.me/calendarsignal/22891

Performance : https://t.me/calendarsignal/22924

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11