Gold (XAUUSD) is entering today’s US session under multi-layered macro pressure. Even before the official release of US JOLTS data at 15:00 GMT, markets are already pricing a risk-on, USD-supportive environment, which historically limits gold upside and increases downside risk.

Today’s given signal : https://t.me/calendarsignal/23365

Why XAUUSD Could Fall Today (3 February 2026) – Pre-Event Outlook

Gold (XAUUSD) is under pressure ahead of today’s US session, as several macro factors are aligning against it. With US JOLTS data scheduled for release at 15:00 GMT, markets are already positioning for outcomes that could favor the US Dollar and weigh on gold prices.

1. Anticipation of Strong US JOLTS Data

JOLTS measures labor demand in the US. If today’s data comes in strong, it would confirm that the US labor market remains resilient. This would reduce expectations for near-term Fed rate cuts, push US yields higher, and support the US Dollar. Since gold does not pay interest, higher yields usually make gold less attractive, leading to downside pressure on XAUUSD.

2. US–Iran Talks Reducing Safe-Haven Demand

Markets are also reacting to news of upcoming talks between the US and Iran on Friday. Any sign of diplomatic engagement reduces geopolitical risk in the Middle East. As a result, demand for safe-haven assets like gold typically weakens, encouraging traders to rotate into risk assets.

3. Hawkish Federal Reserve Member Selection

Reports of a more hawkish Fed member selection signal a “higher-for-longer” interest rate stance. This strengthens the US Dollar and keeps real interest rates elevated — both negative factors for gold prices.

4. CME Increased Margin Requirements for Gold

An increase in CME margin requirements forces leveraged traders to reduce gold positions. This often leads to short-term liquidation and sharp intraday selling, adding technical pressure to XAUUSD.

Possible Gold Price Scenarios

- Strong JOLTS: Gold likely breaks support and moves lower

- Neutral JOLTS: Choppy, range-bound price action

- Weak JOLTS: Short-term bounce, but upside may be limited

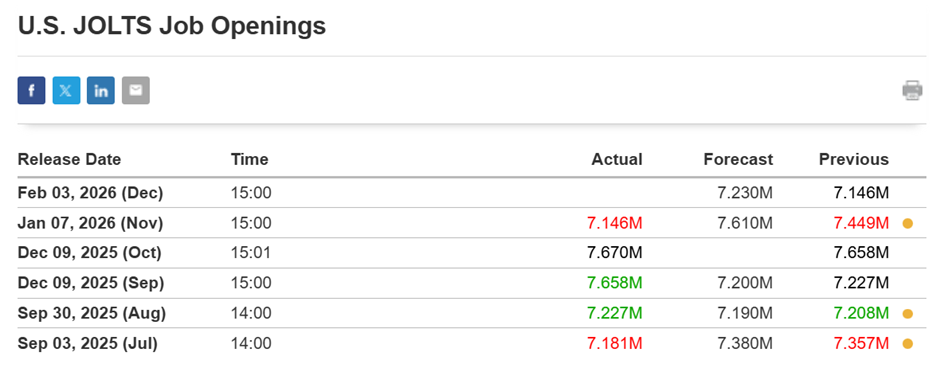

Previous released data results :

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11