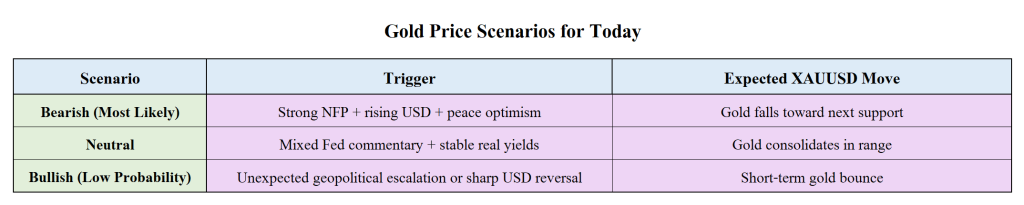

Gold (XAUUSD) is under pressure today as a combination of strong US Non-Farm Payrolls (NFP) and renewed Ukraine–Russia peace talk optimism pushes safe-haven demand lower. The market is reacting to two major forces:

- A solid US labor report, strengthening the US dollar and reducing recession risks.

- Geopolitical de-escalation, reducing global uncertainty and weakening demand for gold.

Today’s given signal : https://t.me/calendarsignal/21752

✅ Why Today’s US NFP Data is Strong – Key Economic Drivers

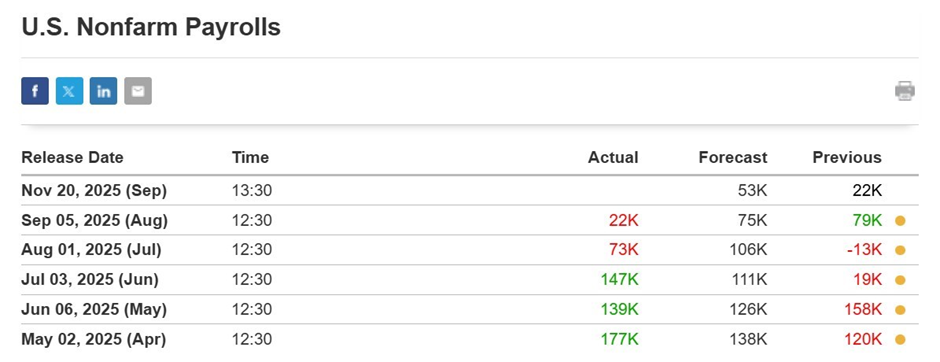

The November 2025 NFP report came in significantly better than expected, signaling continued economic momentum. Here are the main reasons behind the strong reading:

1️⃣ Strong Hiring in Services & Manufacturing

- Healthcare, technology, and manufacturing sectors added the highest number of jobs.

- Seasonal hiring ahead of the holiday period boosted employment figures.

2️⃣ Rising Wage Growth

- Average hourly earnings increased more than forecasts.

- Higher wages → stronger consumer spending → stronger GDP outlook.

3️⃣ Low Layoffs & Stable Jobless Claims

- Jobless claims have been trending downward for weeks.

- This shows companies are retaining workers despite global uncertainty.

4️⃣ Higher Demand from Rebounding Industries

- Transportation & logistics recovered due to eased supply chain bottlenecks.

- Construction hiring picked up as interest rates stabilized.

5️⃣ Improved Business Confidence

- Soft-landing expectations improved corporate hiring plans.

- Many companies resumed expansion projects paused earlier in the year.

Geopolitical Boost: Ukraine–Russia Peace Talks Reduce Safe-Haven Demand

Gold often rises on geopolitical fear.

Today’s renewed peace discussions are viewed as a relief for global markets:

- Lower war risk → lower demand for safe-haven assets like gold.

- Investors rotate toward equities, bonds, and USD instead.

- Volatility drops, reducing speculative gold buying.

How Strong NFP + Peace Talks Impact XAUUSD

1️⃣ Strong NFP → Strong USD → Gold Drops

A strong labor market means:

- Fed may delay rate cuts

- Real yields rise

- USD strengthens

All three factors push gold lower.

2️⃣ Peace Talks Reduce Fear Premium

- Fewer geopolitical risks = less reason to buy gold

- Investors shift to “risk-on” exposure

- Gold loses momentum from safe-haven flows

3️⃣ Stock Market Boost Hurts Gold

- Strong data lifts equity indices

- Traders move money away from gold into higher-yielding assets

4️⃣ Technical Pressure

- XAUUSD breaks below short-term support

- More downside possible if real yields continue rising

Previous released data results :

On last NFP data (24-10-2025) we predicted good NFP data, & as per that we suggest to SELL XAUUSD & as a result, we made a profit of 86 points according to the signal we gave.

Check the previous blog : https://blog.forextrade1.co/gold-in-focus-after-u-s-nfp-data-5-september-2025-market-outlook/

Check last given signal : https://t.me/calendarsignal/20278

Performance : https://t.me/calendarsignal/20302

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11