Global stock markets fell sharply on Monday (August 5), their steepest decline in decades. Investors were nervous for a variety of reasons – such as a growing economic recession in the US and increasing geopolitical tensions in West Asia – but there was also a new global trigger: the unwinding of the yen carry trade.

Yen carry trade: what is it?

Investors around the world are always looking for ways to make money. Borrowing money at a low interest rate in one country and investing it in another where the interest rate is much higher is one way to accomplish this. A carry trade is simply what it sounds like.

Different countries’ central banks keep interest rates at levels that suit their economic conditions, so such opportunities can arise. As an example, Japan’s central bank (the Bank of Japan) kept interest rates at zero percent between 2011 and 2016, and even lowered them below zero (-0.10%) since 2016. Low interest rates are intended to stimulate economic growth.

Japan’s currency, the yen, is trusted, and a “cheap money” monetary policy has global ramifications. In order to earn better returns, investors borrow cheaply in yen to invest in other countries (such as Brazil, Mexico, India, and the US). The yen carry trade is an example of such a carry trade.

Because the BoJ kept interest rates so low for so long – even when central banks across the globe raised interest rates rapidly in response to the Russian-Ukraine war – it encouraged billions of dollars in carry trades based on the “yen,” which fueled investment in several countries.

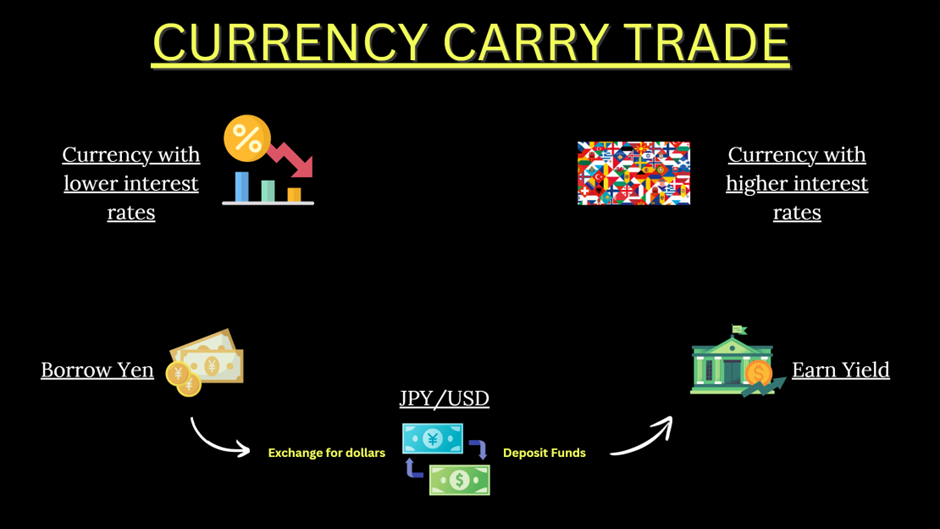

CARRY TRADE: HOW DOES IT WORK?

- Borrowing in Yen: Traders borrow yen at Japan’s low-interest rates.

- Converting to Foreign Currency: They convert the borrowed yen into a higher-yielding currency, such as the US dollar (USD), Australian dollar (AUD), or any other currency offering higher interest rates.

- Investing in High-Yield Assets: They invest in assets denominated in the higher-yielding currency, such as bonds, stocks, or real estate, to earn a return higher than the cost of borrowing the yen.

- Earning the Differential: The profit comes from the difference between the low borrowing cost in yen and the higher returns from the investment.

Illustrative Chart

To visually represent this, let’s create a chart showing the process and the calculations:

- Borrow in JPY at 0.1% interest rate:

- Convert JPY to USD:

- Invest in US asset at 3% yield:

- Earn annual return and convert back to JPY:

- Calculate net profit:

Example Calculation

Assume the following:

- Interest rate in Japan (JPY): 0.1%

- Interest rate in the US (USD): 3%

- Exchange rate (JPY/USD): 110

- Amount borrowed in JPY: 1,000,000 yen

Step-by-Step Calculation

- Borrow in Japanese Yen (JPY):

- Amount borrowed: 1,000,000 yen

- Annual interest cost: 1,000,000×0.1%=1,000 yen

- Convert JPY to USD:

- Exchange rate: 110 JPY/USD

- Amount in USD: 1,000,000/ JPY110 = 9,090.91 USD

- Invest in a US Asset:

- Suppose the trader invests in a US bond yielding 3% annually.

- Annual return: 9,090.91 USD × 3% = 272.73 USD

- Convert USD back to JPY at the end of the year:

- Assume the exchange rate remains constant at 110 JPY/USD.

- Total USD amount after one year: 9,090.91 USD + 272.73 USD = 9,363.64 USD

- Amount in JPY: 9,363.64 USD × 110 = 1,029,000

- Calculate Net Profit:

- Total amount in JPY after conversion: 1,029,000 yen

- Repayment of borrowed amount: 1,000,000 yen

- Interest cost on borrowed amount: 1,000 yen

- Net amount after repayment: 1,029,000 − 1,000,000 − 1,000 = 28,000 USD

So, the net profit from the Yen carry trade in this example is 28,000 yen.

Let’s assume for AUD

- Borrowing cost in JPY: 0.1%

- Investment return in AUD: 3%

- Exchange rate JPY/AUD remains stable.

If a trader borrows 1 million yen, converts it to AUD, and invests in an Australian bond yielding 3%, the annual profit would be:

Profit=(3%×1,000,000 JPY in AUD)−(0.1%×1,000,000 JPY

Profit=30,000 JPY−1,000 JPY

Profit=29,000 JPY

YEN CARRY TRADE: HOW LARGE IS IT?

There is no clear answer. In terms of yen-funded trades worldwide, analysts estimate that Japanese banks have made short-term external loans of $350 billion since March.

The number could be exaggerated if some of those loans were commercial transactions between banks or loans to foreign businesses.

As a result, it may also be underestimating the size of yen carry trades since the Japanese themselves have probably borrowed billions of yen for domestic investments.

By using leverage, hedge funds and computer-driven funds could increase their positions.

A huge amount of Japanese pension funds, insurers, and other investors have made investments abroad as well. At the end of March, Japan had 666.86 trillion yen ($4.54 trillion) in foreign portfolio investments, of which over half were interest rate-sensitive debt assets.

The Yen trade is unwinding for what reason?

In Japan, higher interest rates led to the yen strengthening against the dollar and most emerging economy currencies. The yen’s exchange rate – that is, how many dollars or rupees is one yen worth – has strengthened recently against dollars, reals, rupees, and pesos.

In other words, if assets were converted back into yen, they were worth relatively less. A yen carry trade now comes at a higher opportunity cost due to higher returns on yen investments. It is this narrowing of returns (or yields) differential – and the potential for further movement in this direction – that triggered the slide and led to investors selling their yen-cheap assets.

WHERE TO CONTACT US

Website: https://forextrade1.co/

Twitter: www.twitter.com/forextrade11

Telegram: telegram.me/ftrade1

Facebook: www.facebook.com/Forextrade01

Instagram: www.instagram.com/forextrade1

YouTube: www.youtube.com/ForexTrade1

Skype: forextrade01@outlook.com

Email ID: info@forextrade1.com