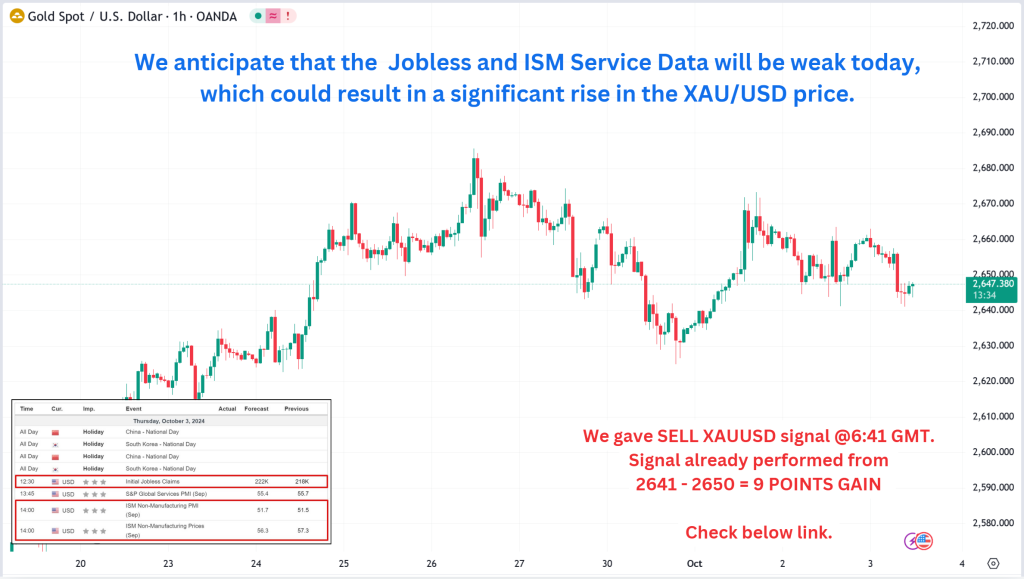

The US job market and service sector activities are expected to show weakness today, which could potentially lead to a rise in the price of gold against the US dollar. The impact of weak jobless data and ISM service data on gold prices has been analyzed and discussed in the below sections.

Today’s given signal : https://t.me/calendarsignal/15383

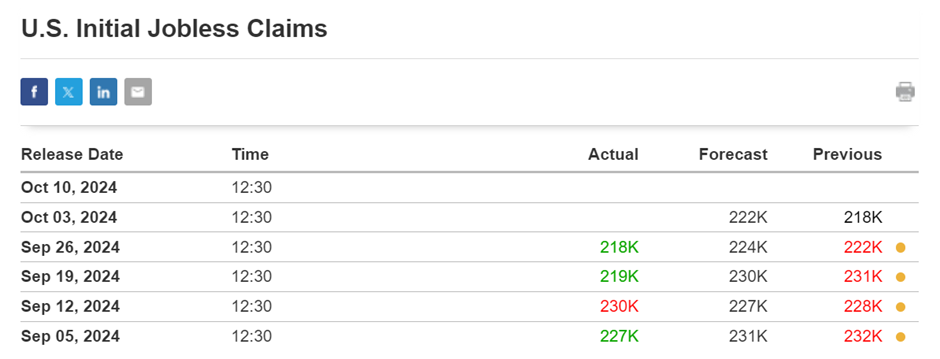

The jobless data is a key indicator of the strength of the labor market. A weak reading can indicate high unemployment levels, which can have a negative impact on the economy. When jobless data is weak, investors tend to favor safe haven assets such as gold, as they see it as a store of value during times of economic uncertainty.

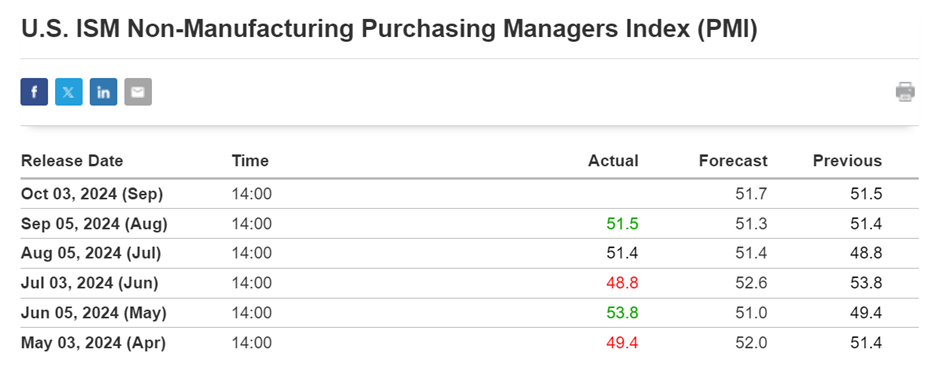

Similarly, the ISM non-manufacturing index, which measures the health of the service sector, is also expected to be weak. A weak reading can indicate reduced economic activity and slower growth in the service sector, which is a significant component of the Uv.S. economy. When ISM data is weak, investors may turn to gold as a hedge against potential weakness in the broader market.

The combination of weak jobless and ISM data released today is likely to drive demand for gold, leading to a higher price for the XAUUSD pair. Investors may look to gold as a safe-haven asset and seek protection against potential weakness in financial markets.

It is important to note that the XAUUSD price is impacted by various factors, and this prediction may not materialize exactly as forecasted. However, the weak jobless and ISM data released today are likely to contribute to the potential upward movement of the XAUUSD price on 3rd October 2024.

Previous released data results :

On the last US ISM Non-Manufacturing data release (5-9-2024), we suggested selling XAUUSD based on strong ADP data, which resulted in a drop in gold prices.

Check last given signal : https://t.me/calendarsignal/14925

Performance : https://t.me/calendarsignal/14939

WHERE TO CONTACT US

Website: https://forextrade1.co/

Twitter: www.twitter.com/forextrade11

Telegram: telegram.me/ftrade1

Facebook: www.facebook.com/Forextrade01

Instagram: www.instagram.com/forextrade1

YouTube: www.youtube.com/ForexTrade1

Skype: forextrade01@outlook.com

Email ID: info@forextrade1.com