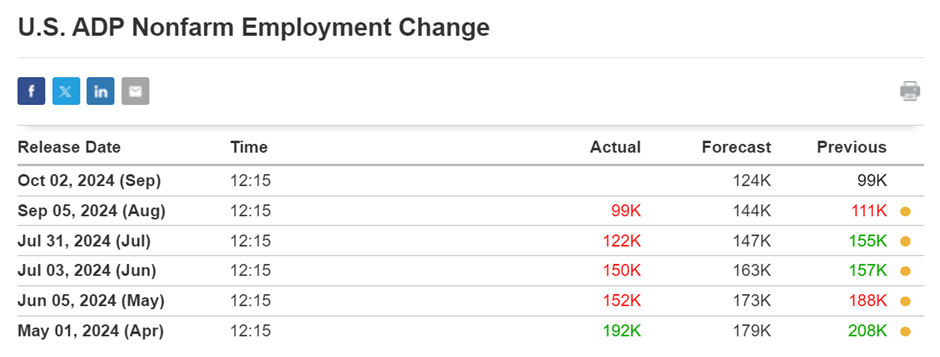

Today’s release of the US ADP employment data has been positive, showing a strong increase in private sector jobs. This upbeat report adds to expectations of a strong employment report for September to be released on Friday. However, the markets are also grappling with geopolitical tensions following the attack on an Iranian military facility. The incident has sparked fears of retaliation and potential escalation in the region.

Today’s given signal : https://t.me/calendarsignal/15363

The positive US ADP data should generally boost investor sentiment and drive markets higher. However, the ongoing tensions with Iran pose a significant risk to the global economic landscape. Investors are cautious and worried about the potential impact on oil supplies and geopolitical stability.

Retaliation Will Take Time

In the aftermath of the Iranian attack, there are concerns about potential retaliation and escalation. The markets have been on edge, fearing further violence and instability. However, it is important to note that retaliation may take some time. Iran is unlikely to escalate the situation immediately, and any potential response is likely to be calibrated and measured.

This delay gives investors time to reassess the situation and adapt to any potential changes in the market. However, it also increases the risk of uncertainty and volatility in the markets, leading to increased fear among investors.

Overbought Gold Will Fall

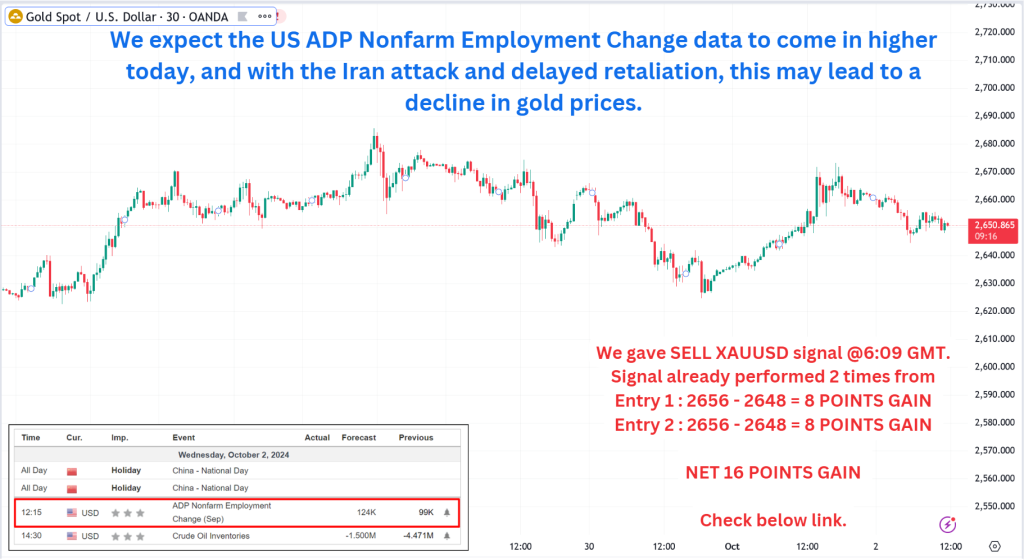

Gold has been a sought-after asset during times of geopolitical tensions and market uncertainty. However, the current gold market is overbought, and a correction is expected. The positive US ADP data and reduced market fear could weigh on gold prices, leading to a decline in the value of gold.

Gold is generally considered a safe haven asset, and investors often flock to it during times of instability. However, now that the markets are calmer and there is less fear, the demand for gold may decline. This could lead to a decrease in gold prices, particularly for gold pairs such as the gold/dollar and gold/euro.

Global Market Fear on the Gold Pair

The attack on an Iranian military facility has spooked global markets, and gold prices are no exception. Investors are wary and concerned about the potential for further violence and instability in the region. This fear has led to increased buying of gold, pushing prices higher.

However, as the situation evolves and the market calms down, the fear surrounding the gold pair may start to decline. Investors may shift their focus to other asset classes, reducing demand for gold and leading to a fall in its price.

Previous released data results :

On the last ADP data (5-9-2024), we suggested selling XAUUSD due to strong ADP data, which led to a drop in gold prices.

Check last given signal : https://t.me/calendarsignal/14925

Performance : https://t.me/calendarsignal/14939

WHERE TO CONTACT US

Website: https://forextrade1.co/

Twitter: www.twitter.com/forextrade11

Telegram: telegram.me/ftrade1

Facebook: www.facebook.com/Forextrade01

Instagram: www.instagram.com/forextrade1

YouTube: www.youtube.com/ForexTrade1

Skype: forextrade01@outlook.com

Email ID: info@forextrade1.com