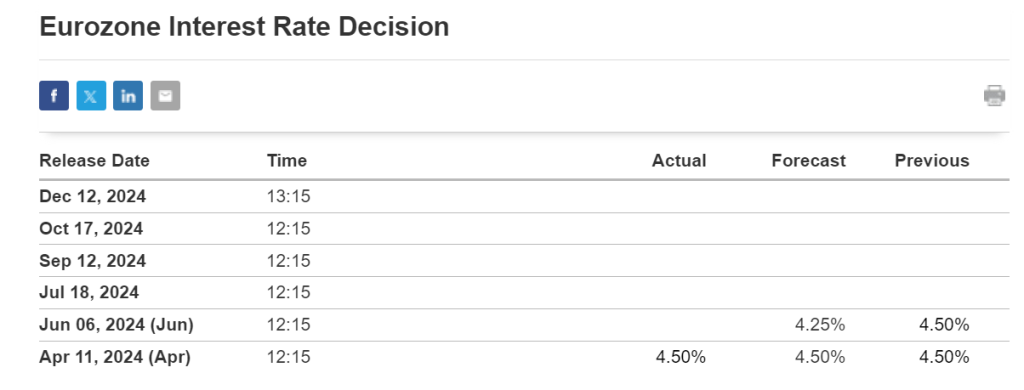

On 6-6-2024, the European Central Bank (ECB) announced a 25bps rate cut to the interest rate, marking a significant development for the EURUSD currency pair. This decision by the ECB is expected to have various impacts on the exchange rate of the EURUSD pair.

Today’s given signal : https://t.me/calendarsignal/12795

The ECB’s decision to cut the interest rate by 25bps was aimed at stimulating economic growth, combating inflation, and supporting the Eurozone’s recovery. By reducing borrowing costs, the ECB hoped that businesses and households would have more access to credit, encouraging them to invest and spend.

However, the impact on EURUSD was complex and multifaceted. On one hand, a lower interest rate tends to weaken the currency as investors seek higher returns in other currencies. The decline in interest rates also encourages capital outflows, as foreign investors move their money to higher-yielding assets.

On the other hand, the interest rate cut indicated that the ECB was concerned about the Eurozone’s economic prospects. This increased the perception of risk in the region, potentially driving up demand for safe haven assets such as the euro. Additionally, lower interest rates can make exports more competitive in the global market, benefiting the Eurozone’s economy and potentially supporting the value of the currency.

Trading Implications

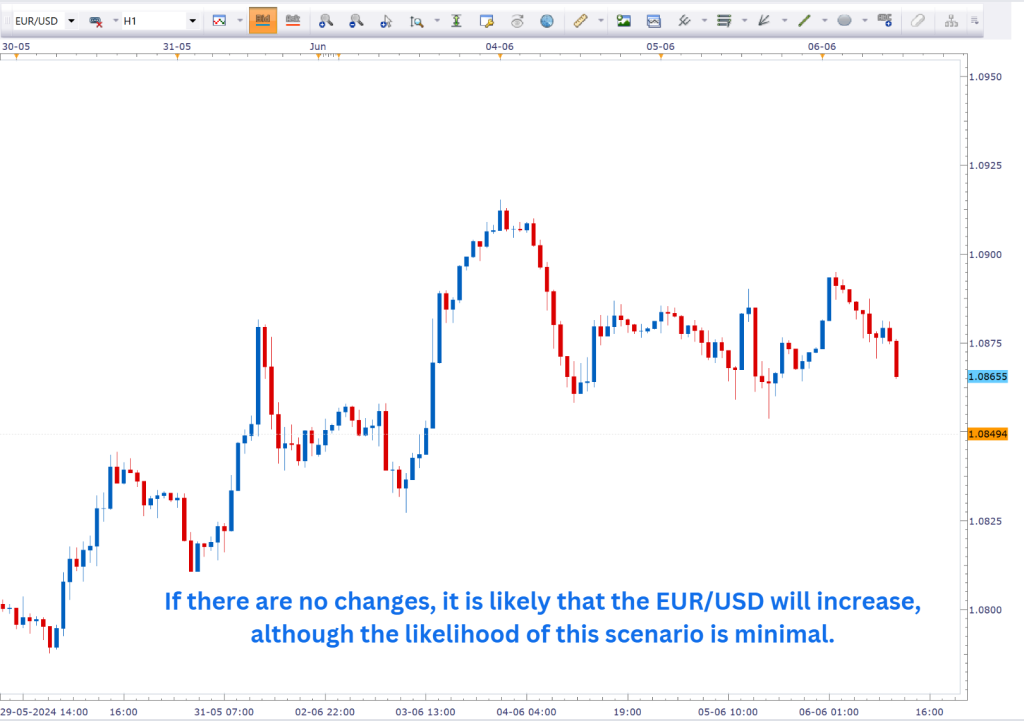

The ECB Interest Rate Decision on 6-6-2024 had a significant impact on the EURUSD currency pair. Immediately following the announcement, the EURUSD exchange rate experienced significant movement. Traders and investors reacted to the news by adjusting their positions, resulting in price fluctuations.

Following the rate cut, the EURUSD exchange rate experienced an initial decline in value. Investors’ expectations of a weaker Eurozone economy due to the rate cut weighed on the euro, causing it to lose ground against the dollar. However, the decline was not sustained and the euro regained some of its value as the day progressed.

The EURUSD’s reaction to the rate cut reflected both its sensitivity to interest rates and its role as a safe haven currency. Investors were cautious in their decision-making, taking into account the underlying fundamentals of the Eurozone economy and the US dollar’s strength.

Previous released data results :

On last rate cut data (11-4-2024) we predict to BUY EURUSD as for Data, EURUSD price was raised.

Check last given signal : https://t.me/calendarsignal/11356

Performance :