Introduction:

When it comes to the gold market, various factors can influence its performance. One of the key indicators to watch is the S&P Global Services Purchasing Managers’ Index (PMI) and new home sales data. In this blog post, we will delve into the significance of these factors and their potential impact on the gold market.

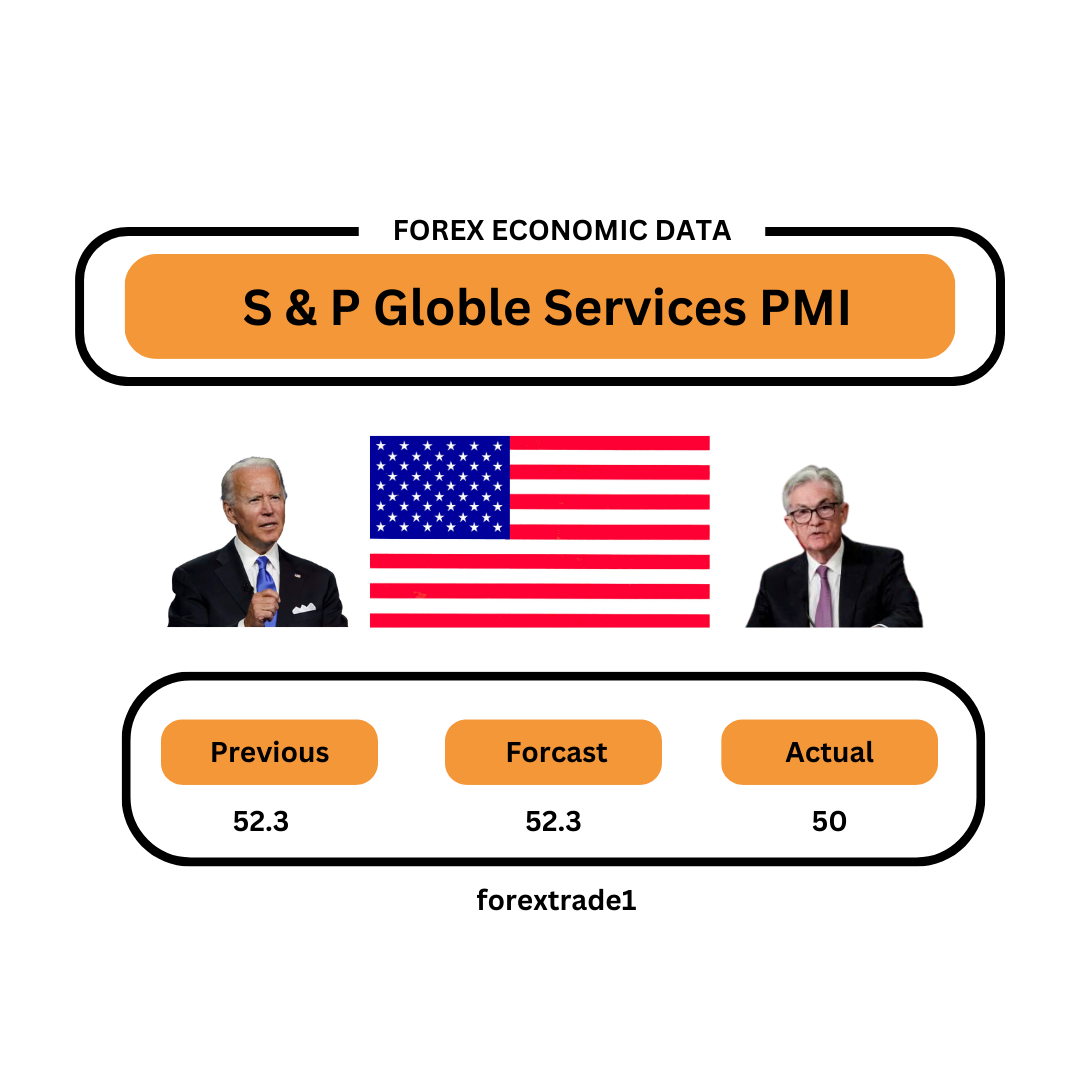

Understanding the S&P Global Services PMI

The S&P Global Services PMI is a vital economic indicator that measures the business activity in the services sector. It provides insights into the health of this sector, which often contributes significantly to a country’s economy. A higher PMI indicates expansion, while a lower PMI suggests contraction. How does this relate to gold? Let’s find out.

The Relationship between Services PMI and Gold Prices

Gold is often considered a safe-haven asset, sought after during times of economic uncertainty. When the services PMI shows a decline, it may indicate a slowdown in economic growth, which can trigger an increase in gold demand. Conversely, if the services PMI is on the rise, signaling economic expansion, gold prices may experience downward pressure as investors move towards riskier assets.

Analyzing New Home Sales Data

New home sales data is another crucial factor to consider when examining the impact on the gold market. The housing market is closely tied to economic conditions, and changes in new home sales can have far-reaching implications. Are there any correlations between new home sales and gold prices? Let’s explore further.

The Interplay between New Home Sales and Gold

Strong new home sales figures often suggest a robust economy, which can potentially divert investor interest away from gold. As consumer confidence grows, individuals tend to explore other investment opportunities, which may result in a decrease in gold demand. On the other hand, if new home sales data disappoints, it could signal economic instability, prompting investors to turn to gold as a store of value.

Conclusion:

In conclusion, the S&P Global Services PMI and new home sales data can be game-changers for the gold market. These indicators provide valuable insights into economic conditions and investor sentiment, which, in turn, influence gold prices. As investors, it is essential to keep a close eye on these factors to make informed decisions regarding gold investments.