Introduction:

The Federal Open Market Committee (FOMC) is set to convene in the near future, and all eyes are on the Federal target rate. As the central bank of the United States, the Federal Reserve plays a crucial role in managing the country’s monetary policy. In this blog post, we will discuss the significance of the Federal target rate and shed light on what we can expect from the upcoming FOMC meeting.

Understanding the Federal Target Rate:

The Federal target rate, also known as the federal funds rate, is the interest rate at which depository institutions lend funds to each other overnight. This rate serves as a benchmark for other interest rates in the economy, including mortgage rates, credit card rates, and business loans. The Federal Reserve indirectly influences this rate through its open market operations.

The Role of the FOMC:

The FOMC is responsible for setting the nation’s monetary policy. It consists of twelve members, including the seven members of the Board of Governors of the Federal Reserve System and five Reserve Bank presidents. Their primary objective is to promote maximum employment, stable prices, and moderate long-term interest rates.

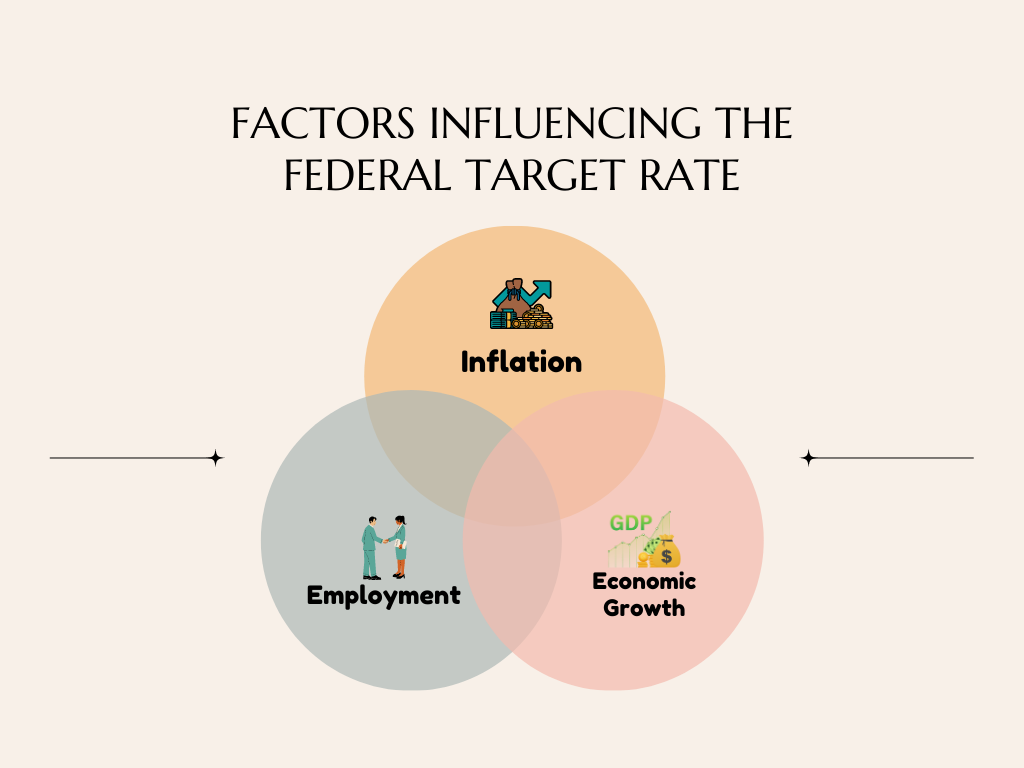

Factors Influencing the Federal Target Rate:

The FOMC considers various economic indicators and factors when determining the Federal target rate. These factors include but are not limited to:

- Inflation: The FOMC closely monitors inflationary pressures in the economy. Higher inflation may prompt the committee to raise interest rates to combat inflationary risks.

- Employment: The state of the job market plays a critical role in the FOMC’s decision-making process. Low unemployment rates and strong job growth may lead to increased interest rates to prevent the economy from overheating.

- Economic Growth: The FOMC assesses the overall health of the economy, including GDP growth, consumer spending, and business investments. Strong economic growth may result in higher interest rates to prevent excessive borrowing and speculation.

Expectations for the Upcoming FOMC Meeting:

While it is impossible to predict the exact outcome of the upcoming FOMC meeting, analysts and market participants closely follow economic data and statements from Fed officials to gauge potential changes in the Federal target rate. Here are a few expectations for the meeting:

- Maintaining the Status : Given the current economic landscape, the FOMC might decide to keep the Federal target rate unchanged. This decision would indicate the committee’s intention to support the ongoing economic recovery without disrupting financial markets.

- Tapering of Asset Purchases: The FOMC might discuss the possibility of tapering its asset purchase program, which involves buying Treasury securities and mortgage-backed securities. Tapering would be a gradual reduction in the amount of monthly purchases, signaling a shift towards a less accommodative monetary policy.

- Forward Guidance: The FOMC may provide updated guidance on its future policy actions, including the timing of potential interest rate hikes or changes in the asset purchase program. This guidance aims to provide clarity to market participants and manage their expectations.

Conclusion:

As the FOMC prepares to convene, market participants eagerly await any announcements regarding the Federal target rate. Understanding the significance of this rate and the factors influencing its determination is crucial for businesses, investors, and individuals alike. By closely monitoring economic indicators and statements from Fed officials, we can gain insight into the future direction of monetary policy and its potential impact on the economy. Stay tuned for the FOMC’s decision and its implications in the coming weeks.