On 9th May 2024, the Bank of England (BoE) will announce its decision regarding interest rates. This decision will have a significant influence on the GBPUSD pair, which is a popular currency pair that represents the exchange rate between the British Pound Sterling and the United States Dollar.

Today’s given signal : https://t.me/calendarsignal/11992

GBPUSD Pair and Interest Rate Decisions

The GBPUSD pair is particularly sensitive to interest rate decisions because both the British Pound Sterling and the United States Dollar are influenced by their respective central banks. Any changes in interest rates by either the Bank of England or the Federal Reserve can impact the value of GBPUSD.

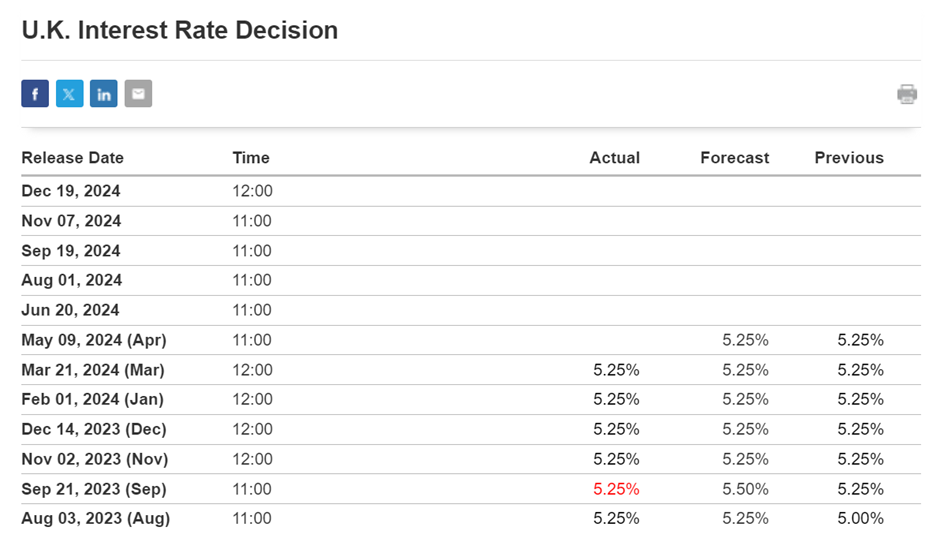

If the BoE decides to hike interest rates, it typically sends a signal to the markets that the British economy is strengthening and may need higher interest rates to control inflation. This would likely lead to an appreciation of the GBPUSD pair, as the British Pound becomes more attractive to investors.

On the other hand, if the BoE decides to keep interest rates unchanged or even cut them, it may indicate concerns about the economy. This could lead to a depreciation of the GBPUSD pair, as the British Pound becomes less attractive to investors compared to the US dollar.

Previous released data results :

On last U.K. Interest Rate Decision data (1-2-2024) we predict to BUY GBPUSD as for rate cut decision GBPUSD price was raised.

Check the previous blog : https://blog.forextrade1.com/euro-cpi-forecasting-analyzing-the-impact-on-eurusd-pair-1-2-2024/

Check last given signal : https://t.me/calendarsignal/10389

Performance :