The impact of negative initial jobless claims and FED rate cuts sooner over banking failure issue data has a significant impact on the XAUUSD currency pair. This document analyzes the effect of these factors on the gold price, which is the underlying asset of the XAUUSD pair.

Today’s given signal : https://t.me/calendarsignal/11990

Negative Initial Jobless Claims

Negative initial jobless claims are two consecutive weeks of declining jobless claims, indicating a decrease in the number of individuals filing for unemployment benefits. This data point is often closely monitored by investors and traders as it can provide insights into the overall health of the economy.

When negative initial jobless claims are recorded, it often indicates that the job market is improving, which can lead to increased consumer spending and economic growth. As a result, the XAUUSD currency pair may experience a positive response as gold, a traditional safe haven asset, may lose its allure during times of economic optimism.

FED Rate Cut Sooner

The FED, or the Federal Reserve, is the central bank of the United States. Its decisions related to interest rates can impact the forex market, including the XAUUSD currency pair. A FED rate cut occurs when the central bank reduces interest rates, which can have both positive and negative effects on the price of gold.

A FED rate cut is often interpreted as a sign of economic weakness or a lack of confidence in the economy. Investors and traders may turn to gold as a hedge against uncertainty or as a way to protect against inflation. As a result, the price of gold may rise, exerting upward pressure on the XAUUSD currency pair.

Banking Failure Issue Data

Banking failure issue data refers to any information regarding potential financial difficulties or failures within the banking industry. This can include news of bank bailouts, regulatory actions, or changes in financial stability indicators.

Banking failure issue data can have a significant impact on the price of gold and the XAUUSD currency pair. During times of financial instability or concerns about the banking sector, investors and traders may turn to gold as a safe-haven asset. This increased demand for gold can drive its price higher, exerting downward pressure on the XAUUSD currency pair.

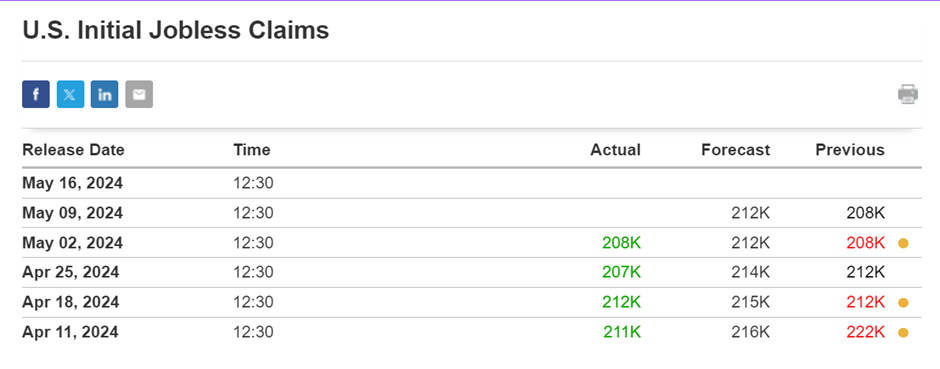

Previous released data results :

Negative initial jobless claims, FED rate cuts sooner, and banking failure issue data all have a profound impact on the XAUUSD currency pair. These factors influence the price of gold, which in turn affects the value of the currency pair. Understanding the impact of these factors can help investors and traders make informed decisions about buying and selling gold.