The release of the US S&P/CS HPI Composite and CB Consumer Confidence numbers today is expected to have a significant impact on gold prices. Based on the available market data and analysis, there is a high likelihood of a decline in gold prices ahead of this data release.

Today’s given signal : https://t.me/calendarsignal/12496

Gold is often used as a hedge against inflation and uncertainty, and investors often turn to gold in times of economic turmoil. However, recent economic indicators suggest that the US economy is improving, which may lead to a decrease in demand for gold.

The US S&P/CS HPI Composite is a weighted average of single-family house prices in the United States. A rise in the index suggests that the housing market is strengthening, which may indicate improved economic conditions and confidence. Conversely, a decline in the index could signal weakness in the market and the potential for lower gold prices.

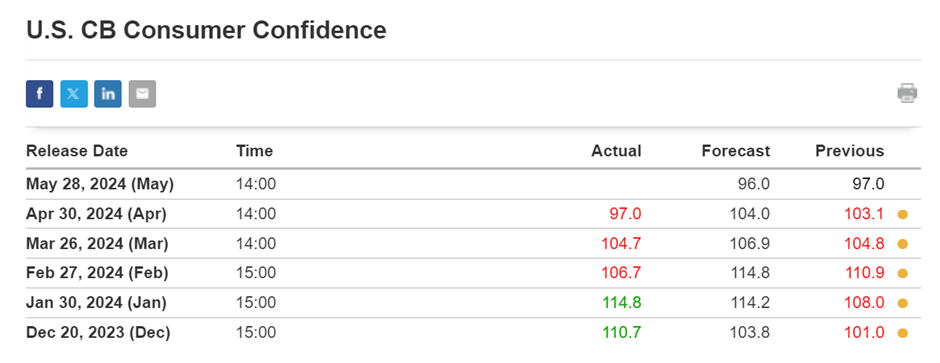

The CB Consumer Confidence Index is a survey of consumers’ attitudes regarding their personal financial situation and the economy as a whole. A high level of consumer confidence generally indicates a more positive outlook, which may lead to a decrease in demand for gold as a safe-haven asset. Conversely, a decline in the index could indicate increased uncertainty and a desire for more gold as a hedge.

In today’s case, analysts are expecting the US CB Consumer Confidence numbers to decline, which would likely result in a decrease in gold prices. There are several reasons for this expected decline.

Secondly, inflationary pressures have been building up, leading to higher bond yields. Gold is often seen as a hedge against inflation, but higher bond yields can make investing in gold less attractive.

The US dollar has been strengthening against other currencies, making gold more expensive for foreign investors. A stronger dollar can make gold less attractive as a store of value and drive down its price.

It is important to note that the accuracy of these predictions can vary depending on the specific factors influencing the market. However, analysts generally agree that the dip in gold prices before the release of the US CB Consumer Confidence numbers is a common occurrence.

Investors looking to capitalize on this dip in gold prices should carefully consider their investment objectives and risk tolerance levels. Timing the market can be challenging, and it is important to conduct thorough research on the underlying factors before making any investment decisions.

Previous released data results :

On last CPI data (30-4-2024) we predict to BUY XAUUSD as for bad CB Consumer Confidance Data, XAUUSD price was raised.

Check the previous blog : https://blog.forextrade1.co/impact-of-us-consumer-confidence-chicago-pmi-on-gold-pair-30-4-2024/

Check last given signal : https://t.me/calendarsignal/11787

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11