The gold market has significant implications for the global economy, as it is often considered a safe haven asset during times of economic uncertainty. One significant factor that can impact gold prices is the performance of the US economy. This document aims to forecast gold trends based on US lower GDP, with a specific focus on the period between May 30, 2024.

Today’s given signal : https://t.me/calendarsignal/12580

Forecasting Gold Trends in Based on US Lower GDP – May 30, 2024

Based on the given date, May 30, 2024, and the assumption that US GDP decreases, the following forecasting scenarios can be considered:

Scenario 1: GDP Contraction

If US GDP contracts, it can have a negative impact on gold prices. In this scenario, investors may perceive a decrease in economic activity as a signal that inflation may be on the horizon. This, in turn, can lead to an increase in demand for gold as a hedge against inflation. As a result, gold prices may rise.

Scenario 2: GDP Slowdown

If US GDP experiences a slowdown instead of a contraction, the impact on gold prices may be less significant. In this scenario, investors may perceive that the decrease in GDP growth is not severe enough to warrant a significant increase in gold demand. As a result, gold prices may remain relatively stable.

Scenario 3: GDP Recovery

If US GDP recovers and registers growth, it can have a positive impact on the gold market. In this scenario, investors may view the increase in GDP as a sign of economic stability. This, in turn, can lead to a decrease in gold demand as investors shift their focus to other assets. As a result, gold prices may decline.

Forecasting gold trends based on US lower GDP is a complex task that involves considering various economic factors. In the above scenarios, the impact of US lower GDP on gold prices has been analyzed. The scenarios suggest that gold prices may rise if GDP contracts, may experience a relatively stable price if GDP experiences a slowdown, and may decline if GDP recovers. However, it is essential to note that the forecasting of gold trends is dynamic and influenced by multiple factors, and this forecast should be regarded as one possible scenario.

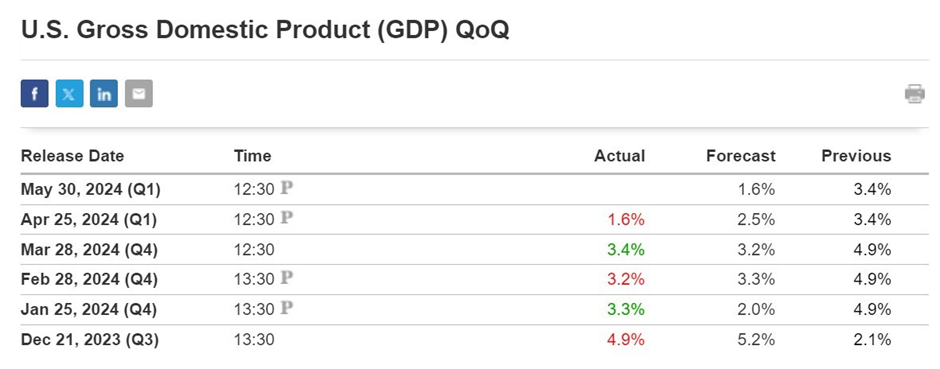

Previous released data results :

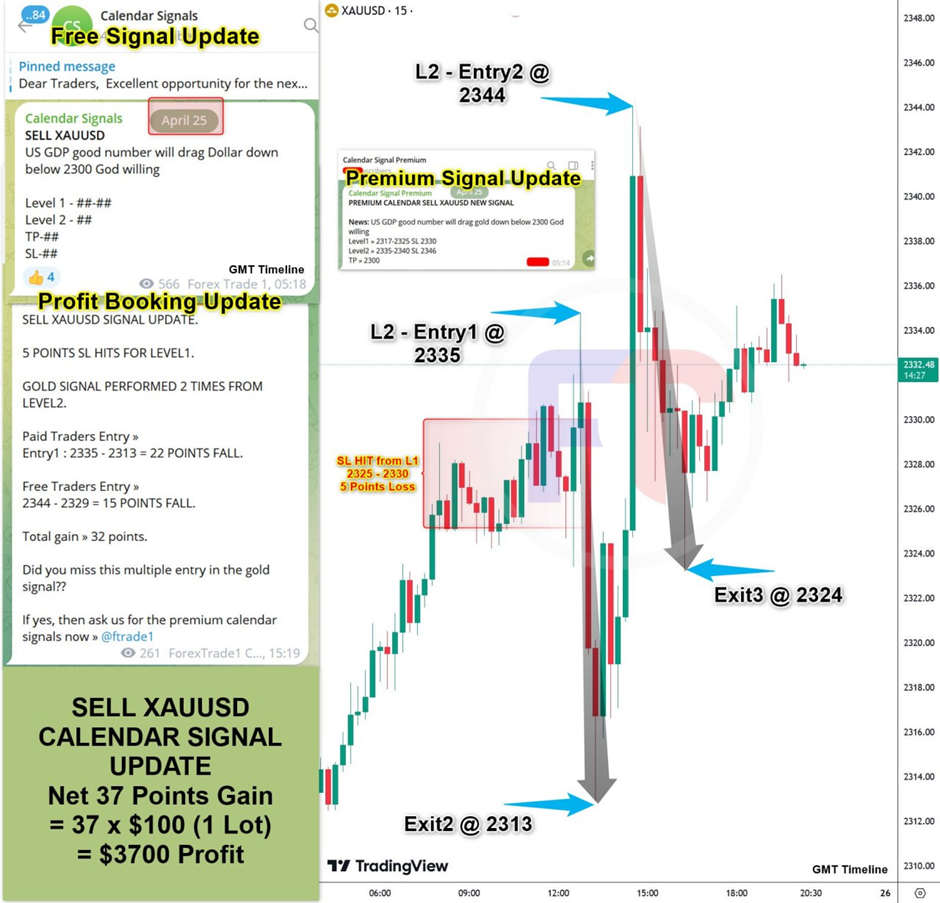

On last data (25-4-2024) we predict to SELL XAUUSD as for good GDP Data, XAUUSD price was fall.

Check last given signal : https://t.me/calendarsignal/11708

Performance :